Pricing Management: VAT Settings (UK Marketplace)

For European marketplaces, including the UK, there are several options where you can enter your VAT.

If you are operating in the UK marketplace, you must register your business for VAT with HM Revenue and Customs (HMRC) if your VAT taxable turnover is more than £85,000. You can enter this amount into the “VAT on Sales” section of the platform.

Furthermore, in the UK marketplace, if you do not have a turnover that is more than £85,000, you will not pay taxes on sales, but pay them to Amazon as “VAT on Fees”. EVA will get that VAT through your Amazon fees. The idea behind this is that although you are not VAT registered, you are selling on Amazon and Amazon has to pay VAT for your product on your behalf. Therefore, you will be indirectly paying VAT through Amazon.

If you are operating in other European marketplaces, you must pay VAT according to the country’s compliance regulations.

If you are VAT-registered

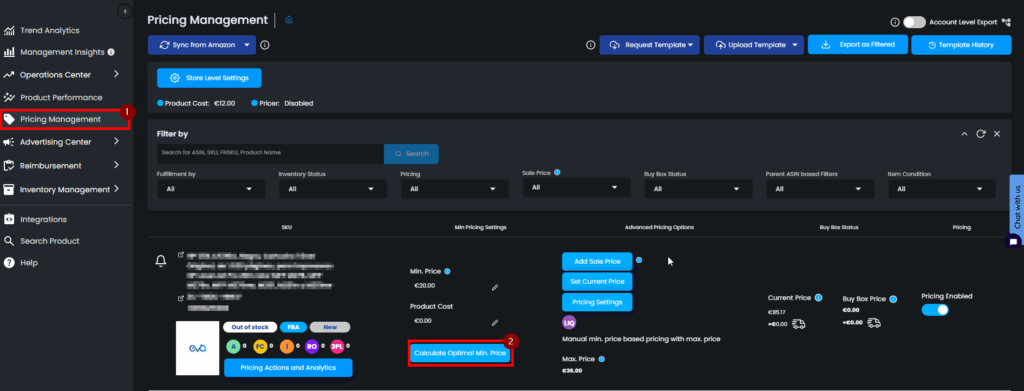

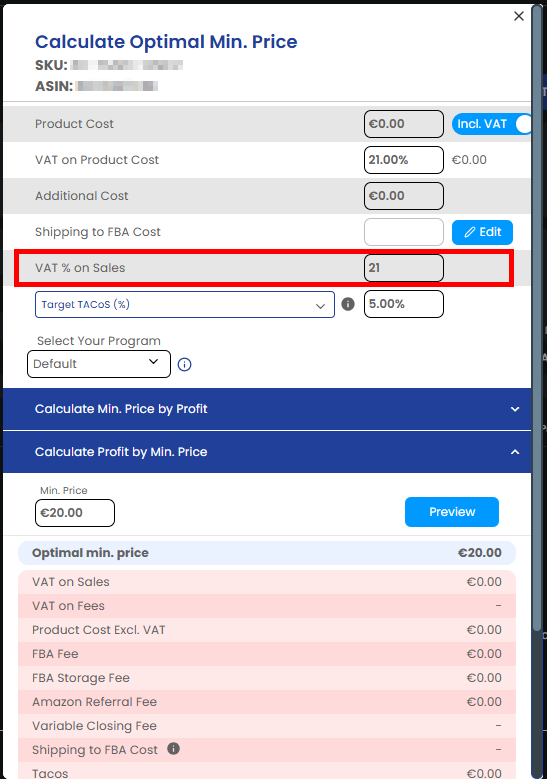

On your SKU card, you will see the “Calculate Optimal Min. Price” button. Clicking on that will open the pop-up to calculate your optimal min. price.

Please Note: You can enter your VAT amount into Eva while calculating your min. price. This will enable you to get the optimal calculation for your min. price.

On the pop-up, you can see the “VAT % on Sales” section where you can enter your values if you are VAT registered. Your VAT amount will be shown below on the calculation.

If you are not VAT-registered

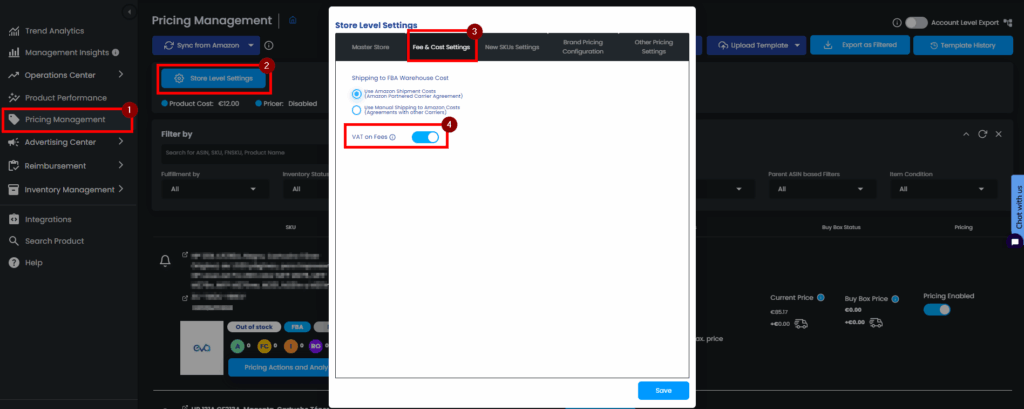

You should activate “VAT on Fees” under the Store Level Settings in the Pricing Management section.

In the “Fee & Cost Settings” tab activate the “Vat on Fees” toggle.

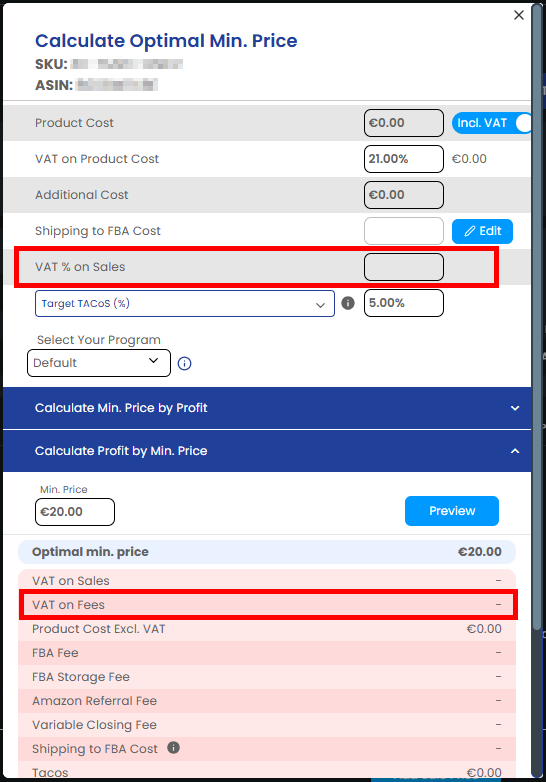

After activating it, your VAT will be calculated based on your Amazon fees. Do not enter any value on the “VAT % on Sales” section so your VAT can automatically be calculated by Eva.

By applying these steps, Eva will take the VAT amount into consideration while calculating your optimal min. price and you will see the most optimal result.

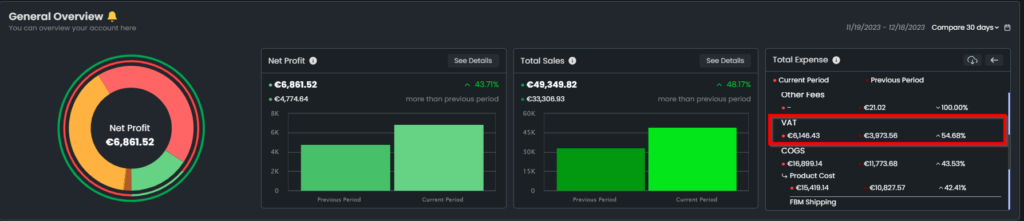

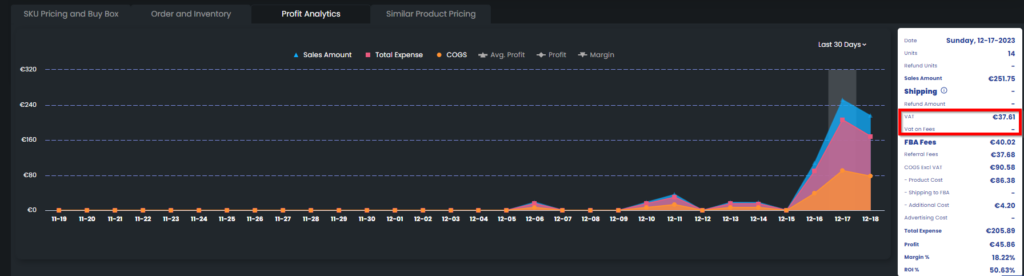

You can see your VAT on the store level in the Store Overview and SKU level in the profit calculation on profit analytics.

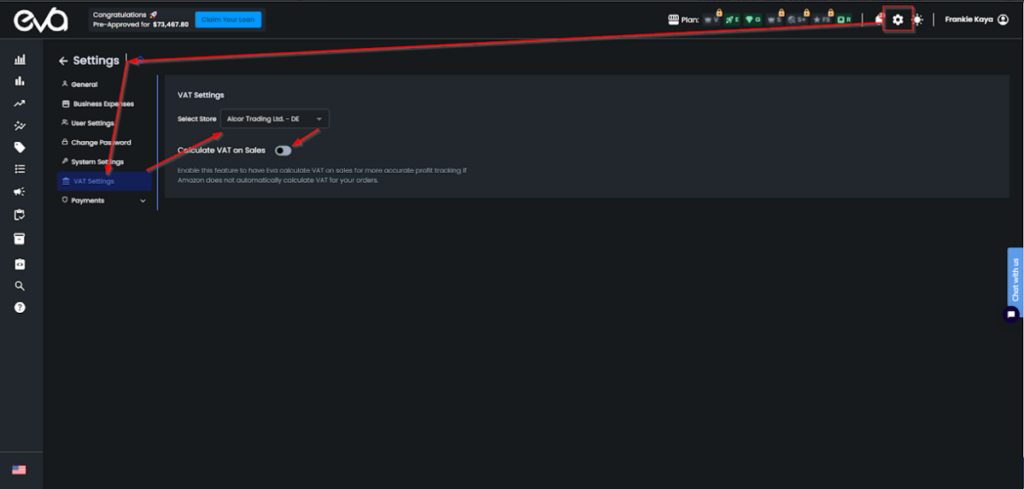

Calculate VAT on Sales

This setting, now available in the Store Level Settings > VAT Settings, allows you to enable VAT calculations on sales directly within the Eva platform. By activating this feature, Eva will calculate VAT for your sales when Amazon does not automatically do so, ensuring more accurate tracking of key metrics such as Profit, ROI, and Margin.

With this feature enabled, you’ll now see updated VAT-included metrics such as Profit, ROI, and Margin in your reporting. These calculations are based on the VAT rate at the time of sale, so any changes to VAT rates will only apply to future transactions, maintaining the integrity of your historical data.

Note: This is only available for EU stores.

“Ready to Elevate Your Success? Schedule a call with our experts today – simply click this link and choose a time that works best for you!”