Pricing Management: Profit Margin VS. ROI

When it comes to calculating your profit, two different metrics can guide you: “ROI” (return on investment) and “profit margin“.

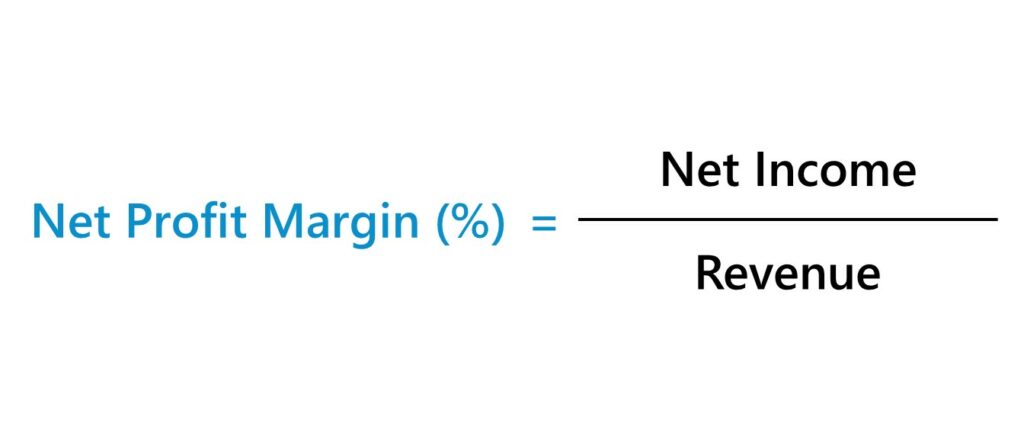

Profit Margin

Profit Margin is a profitability ratio that measures the amount of net income earned with every dollar of sales generated.

Profit margin can be calculated with the following formula: Profit / Revenue.

Here, the cost and fees should be considered to calculate the correct profit margin.

Let’s make it more clear with an example. You buy a product for $30 and want to sell it for $100. Amazon cuts of 15% fee, which means $15 goes to Amazon. As a result, the profit is $55. (Revenue ($100) – Cost ($30) – Fees ($15))

By calculating the profit, we can find the profit margin: Profit ($55) / Revenue ($100) = 55%

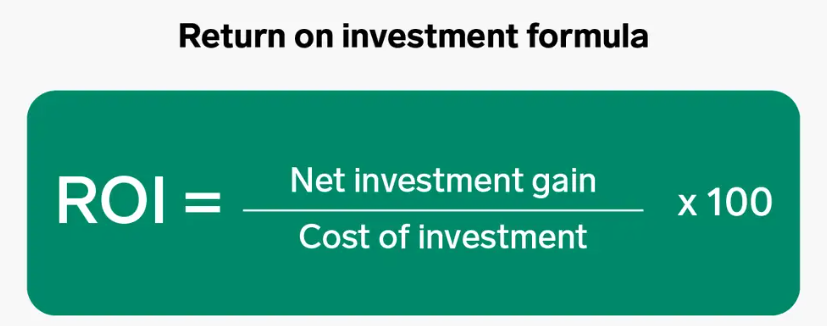

ROI (Return on Investment)

ROI (Return on Investment) is a metric used to evaluate the efficiency or profitability of an investment. It tells how much you gain for a single dollar you spend. The higher ROI, the better.

Return of investment can be calculated by the following formula: Profit / Cost x 100

Based on the previous example, let’s assume the profit is $55, whereas the cost is $20. The ROI will be: Profit ($55) / Cost ($20) = 275%

Don’t be confused with all these numbers and formulas.

Let Eva calculate for you and help you on your way to having better profits!

“Ready to Elevate Your Success? Schedule a call with our experts today – simply click this link and choose a time that works best for you!”